Pay less rent.

Save for your future.

Own your own home.

The Women’s Housing Initiative (WHI) in the suburb of Strathnairn is the first Build to Rent to Buy (BtRtB) of its kind in the ACT. Providing a stable and secure 10-year pathway for working women, from affordable renting to home ownership based on projected savings, Strathnairn includes 22 brand new one, two and three-bedroom townhouses.

Thank you to those who have submitted Expressions of Interest.

Expressions of Interest have now closed.

We thank you for your patience while we continue our review.

Next steps:

Sit tight, we will be in touch soon.

You will soon hear from us on email as to whether you have been successful or unsuccessful to progress to a full application.

If you have been successful to progress further, you will be invited to make a full and formal application and advised on what your next steps will be.

Why this works

The Strathnairn Women’s Housing Initiative is the first Build to Rent to Buy program of its kind in the ACT.

It is designed to directly address the widening affordability gap faced by working single women who have stable employment but are unable to save a sufficient deposit or meet strict lending requirements to buy their own home.

Instead of offering a short-term fix, the program takes a disciplined, sustainable approach to home ownership, one

that builds capability, confidence, and lasting financial stability.

Program Brochure

Download Now

Media Release

Download Now

How it works

Learn more ↓

Am I eligible?

Learn more ↓

How to apply

Learn more ↓

FAQs

Learn more ↓

22 high-quality townhouses designed for real lives.

You’ll choose from one, two or three-bedroom layouts in a brand-new development at Strathnairn, a growing community in West Belconnen.

- Sustainable, energy-efficient designs.

- Open-plan living with natural light.

- Landscaped outdoor spaces.

- Easy access to parks, services and transport.

- Designed with safety and community in mind.

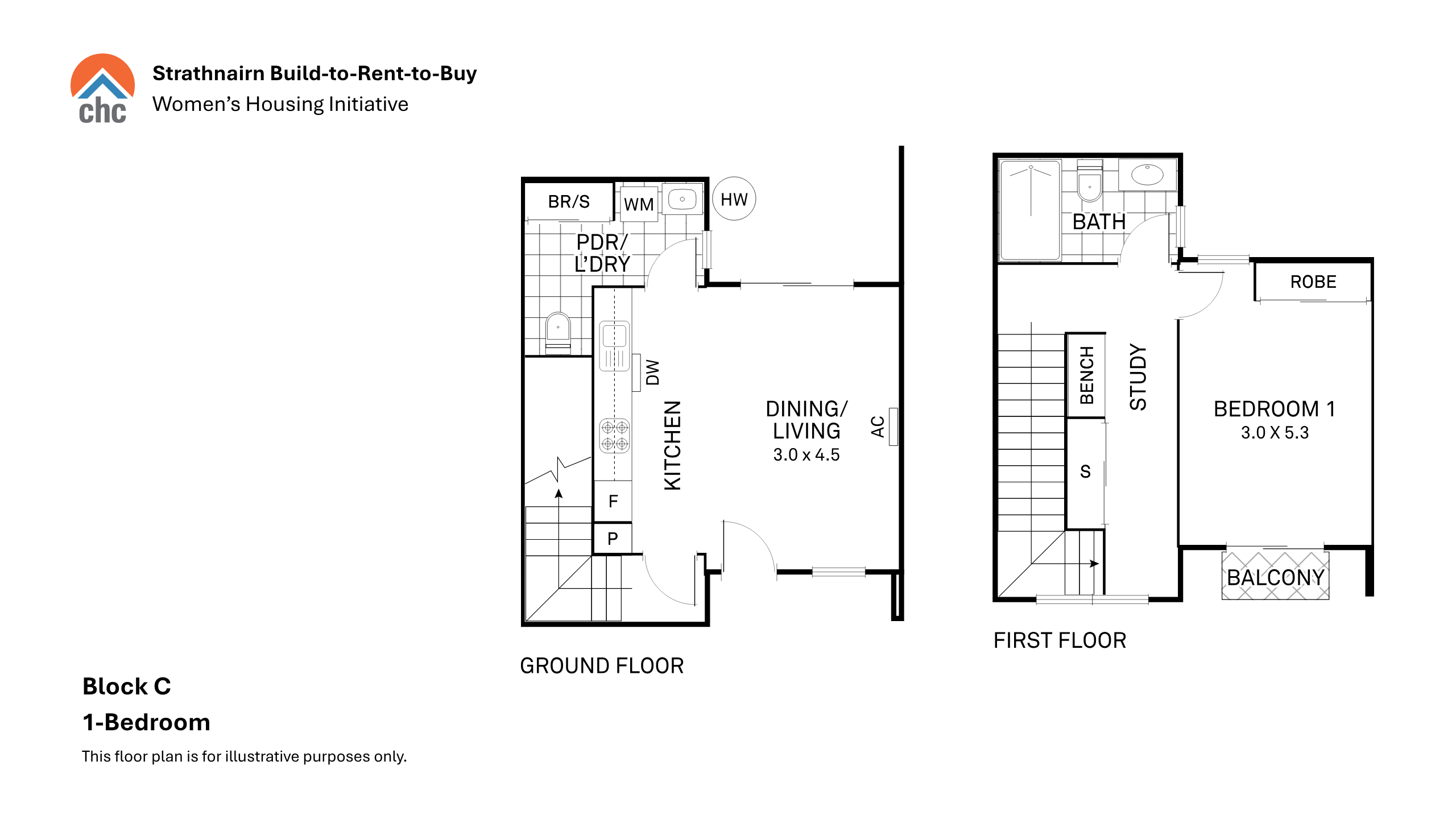

1 Bedroom Townhouses

Perfect for single women ready to live independently, these modern one-bedroom homes offer secure, low-maintenance living with affordable rent and the opportunity to build savings toward ownership.

Car Spaces: 1

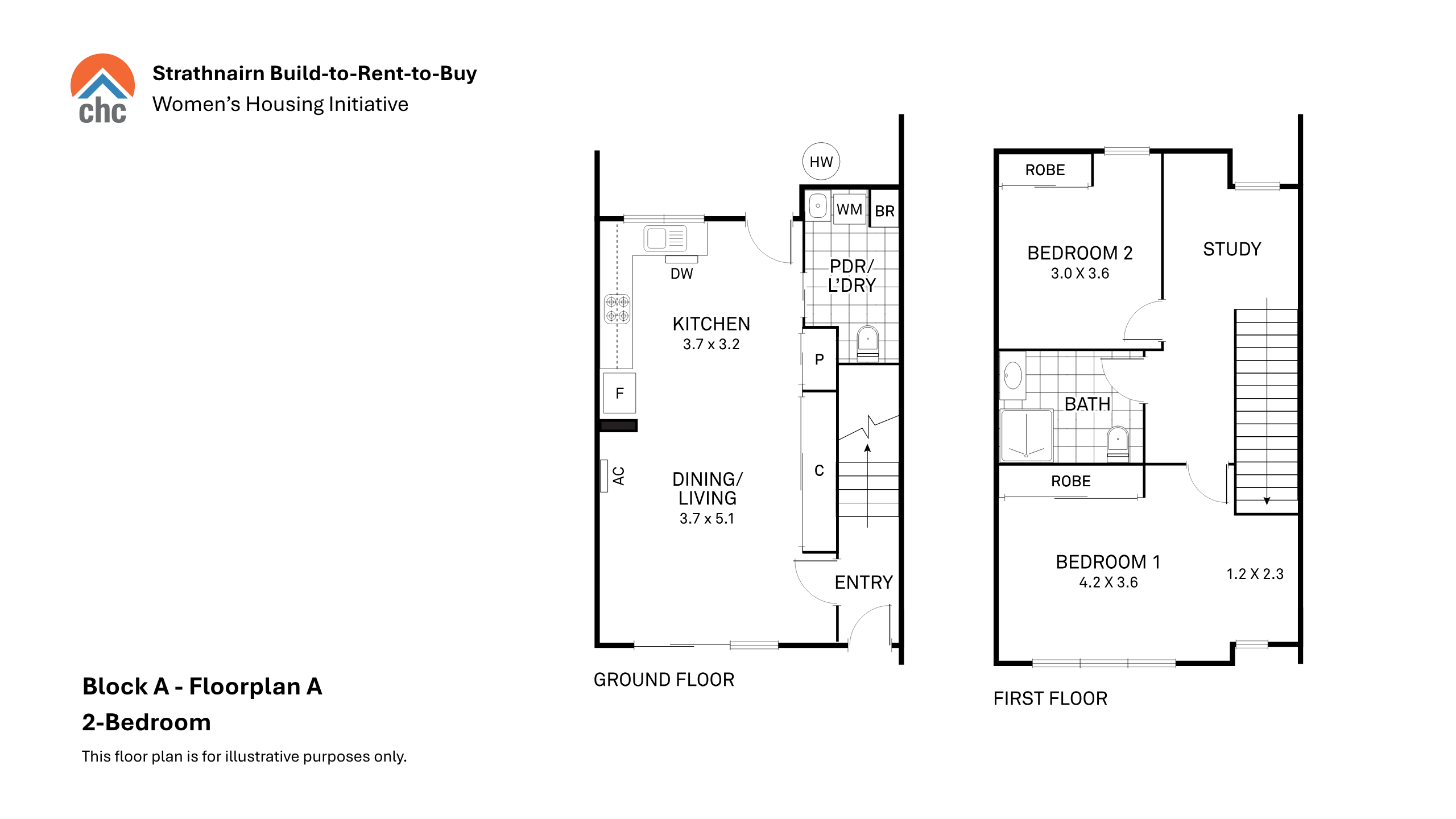

2 Bedroom Townhouses

Designed for single women with one child, these bright,

energy-efficient homes balance space and comfort, providing stability and a clear pathway to buy in the future.

Car Spaces: 1 or 2

3 bedroom Townhouses

Spacious and family-friendly, these three-bedroom homes give single mothers with two or more children the security of long-term affordable rent and the foundation to own their home within a decade.

Car Spaces: 2

Gallery

Take a closer look at the Strathnairn homes – modern and sustainable townhouses set within a connected community, designed for women building secure and independent futures.

Location and amenities

Close to nature. Close to community. Easy to get anywhere.

Strathnairn sits on the edge of West Belconnen, where open green spaces, walking trails and community life come together. It is a neighbourhood designed around connection – easy access to nature, everyday essentials close by, and a growing local centre that is becoming the heart of the community.

The development is moments from parklands, playgrounds, arts facilities and shared community spaces, with quick links to Kippax, Belconnen and the wider city. Public transport, bike paths and major roads make trips to work and study simple, while the nearby Strathnairn Arts precinct, Paddys Park and the wider Ginninderry network offer a mix of culture, recreation and natural outlooks.

- Located directly opposite Ginninderry’s first local retail centre, anticipated for completion in 2027 (subject to town approvals).

- Just 800m from the new Strathnairn Early Childhood to Year 6 Primary School, catering to more than 600 students (planned opening, 2026).

- Less than 50m from a bus stop with free Ginninderry bus services to Kippax.

- Properties due for completion early 2026.

How Build to Rent to Buy works

Your pathway from renting to owning

Rent is set at below 75% of market rate

Affordable rent is below 75% of the market rate so you can live affordably and save faster.

Secure tenancy for 10 years

As long as you remain eligible and meet your tenancy requirements, you have secure, stable housing for up to ten years to build your savings through affordable rent.

Save the difference

With the affordable rent providing financial breathing room, you are

expected to save about three quarters of the gap between the market rent and your discounted rent, while keeping total housing costs below 30 per cent of your gross income.

First right to buy from Year 6 up to year 10

You’ll have the first option to buy your home (subject to meeting specified savings targets and other requirements) and to work with your lender of choice to make sure your purchase is affordable and sustainable.

Extra support if needed

If you’ve saved steadily but still need a bit more help to buy, CHC is

is willing to explore other potential home purchase options such as

using part of the increase in the home’s value to reduce the market

price to make your purchase more achievable.

Please note: Any future share in the property’s value is not guaranteed. The way this value is shared or applied depends on the program rules at the time you purchase. Participants should review the full program terms to make sure they understand how the model works and what may or may not apply in their situation

From Applying to Buying – Your Full Program Journey

You’re not just renting, you’re building savings, confidence, and control over your financial future.

Expression of Interest

Complete the online form, ensuring you check eligibility and register your interest in the program.

Invitation to Apply

Every EOI is assessed carefully. If you meet the eligibility criteria, program requirements and align strongly with the program, CHC may invite you to submit a full application.

Financial Readiness Meeting

Before applying, you’ll need to meet with your bank of choice or one of CHC’s nominated financial readiness partners to discuss your financial position and what will be required to buy by Year 10.

Application Submitted

You submit your application along with all required evidence and statutory declarations for CHC to assess fairness, readiness, and fit for available homes.

Program Entry & Allocation

Successful applicants are allocated a home that fits their preferences and needs and offered an Option Deed to have first right of purchase in future years.

Renting your Home

Live in your Strathairn home under an affordable rental agreement. Rent stays under 75% of market rate.

Saving your Deposit

You are expected to save three quarters of the gap between the market rent and your discounted rent, while keeping total housing costs below 30% of your gross income.

Ready to Purchase

Between years 6 and 10, if you’re ready to buy, CHC will obtain an independent valuation which will

inform the purchase price and check that any grants, project costs and remaining debt are covered before applying any program benefits.

Bank Assessment

You speak with your lender to find out what you can reasonably afford to borrow and repay (keeping mortgage costs below 30% of gross income).

CHC Can Help

If you’ve saved steadily but need more help, CHC may apply a share of the property’s increase in value to help lower the purchase price and make your purchase achievable.*

Home Ownership

You enter home ownership with equity in your home, growing household wealth and a loan you can sustainably repay.

* Any future share in the property’s value is not guaranteed. Participants should review the full program terms to make sure they understand how the model works and what may or may not apply in their situation.

Read Sophie’s Journey to Owning Her Home

Sophie gains three clear benefits:

- Lower rent and long-term stability.

- A solid savings foundation made possible by the financial breathing room in her rent.

- A potential $82,000 affordability boost that makes buying achievable.

Meet Sophie

Fictional Case Study: Sophie is an enrolled nurse working in Canberra Hospital. She earns an average of $80,000 per year, just enough to get by but she spends more than 30% of her gross income in rent alone and is in rental stress; paying $500 a week in rent makes it tough to build a deposit.

Sophie’s Journey to Owning Her Home

| Stage | What Happens | Simple Explanation |

|---|---|---|

| 1. Program Entry | Sophie moves into a 1-bed home and pays $350/week instead of $470/week. | She pays cheaper rent. About three quarters of the $120 she saves each week becomes her deposit plan. |

| 2. Rent & Save | Sophie saves about $4,700 each year from her rent discount. | She builds up good savings while living comfortably. |

| 3. After 10 Years | Sophie has saved $58,000. Her income has grown to $110,000*. | After 10 years, she has a strong deposit. |

| 4. What the Bank Will Lend | The bank says she can borrow $475,000 based on her mortgage payments not exceeding 30% of gross income. | Her savings + loan = $532,000 total she can spend. |

| 5. Home’s Market Value | The home is worth $614,000 in Year 10. | She can afford $532,000, but the home costs more. |

| 6. CHC Can Help | If Sophie has met the program requirements, CHC may apply $82,000 of the capital growth to bridge the gap between market price and what Sophie can afford. | CHC uses part of any increase in the home’s value to bring the purchase price to Sophie’s affordable price. |

| 7. Final Purchase | Sophie buys the home for $532,000. | She buys the home using $58,000 in savings, a $82,000 capital growth contribution and a $475,000 loan. Together, the savings and shared growth give her $140,000 in equity when she becomes the owner. |

*Figures are indicative only and reflect modelling based on current market settings, typical wage growth, and a standard 30-year principal-and-interest loan structure. Actual outcomes may/will differ.

Am I eligible?

Who can apply?

You may qualify if you:

- Are an Australian citizen or permanent resident.

- Are a single woman aged 25–45 (with or without dependent children).

- Don’t own property or have assets or savings that could already meet your housing needs.

- Have lived in the ACT for at least 6 months.

- Can sustain a tenancy and demonstrate capacity to save.

- Meet the income eligibility requirements.

Income settings

The income settings for the Build-to-Rent-to-Buy program are designed to be clear, fair, and supportive of long-term success. CHC uses a combination of ACT and NSW affordable housing income thresholds to make sure the program reaches the people it is designed for. These settings allow working women on moderate incomes to participate while still meeting all affordability requirements.

How the Minimum and maximum income requirements work

- Minimum income guidance help applicants understand the level of income likely to support saving and being ready to buy at Year 10.

- Maximum income limits are fixed thresholds that make sure the program stays transparent, consistent, and focused on those who need it most.

Indicative Minimum Income Guidance

| Household Type | Indicative Minimum Income | Property Type |

|---|---|---|

| Single woman, no children | $80,000 | 1-bedroom |

| Single woman with one child | $105,000 | 2-bedroom |

| Single woman with 2+ children | $110,000 | 2 or 3-bedroom |

Maximum Program Income Thresholds (Fixed)

| Household Type | Max Entry Income | Ongoing Proram Cap | Property Type |

|---|---|---|---|

| Single woman, no children | $105,000 | $120,000 | 1-bedroom |

| Single woman with one child | $125,000 | $160,000 | 2-bedroom |

| Single woman with 2+ children | $130,000 | $176,000 | 2 or 3-bedroom |

Register your interest

Take the first step towards homeownership. Complete the form and our team will contact you with more information about the Women’s Build to Rent to Buy program.

Expression of Interest Application

The EOI process was open for six weeks and closed on Friday, 9 January 2026. After the EOI period ends, the CHC Tenancy Allocation Panel will review all submissions and consider a range of factors in assessing eligibility and alignment with the program’s objectives.

Make a general enquiry instead

Frequently Asked Questions

& More Information

Your questions answered.

What is the Strathnairn Women’s Housing Initiative (WHI) Build to Rent to Buy (BtRtB) program?

The Strathnairn WHI Initiative BtRtB program (Program) is a unique housing initiative in the ACT, designed to help working single women who can’t save a deposit or meet bank lending rules to eventually own their own home. It is managed by Community Housing Canberra Limited (CHC), and it offers a clear, step-by-step pathway from renting to buying, with affordable rent and structured savings to help you build towards ownership.

Who can apply for the Program?

You can apply if you:

- are an Australian citizen or permanent resident

- are a single woman aged 25–45 (with or without children)

- are currently living in the ACT (and have done so for the previous 6 months or more)

- do not already own a home, have a mortgage or assets/savings that could meet your housing needs in the private market

- meet the Program’s income requirements

- are willing and able to save towards buying a home

- are able to sustain a tenancy under the Program’s terms

Do I have to buy the home at the end?

No, there’s no obligation to buy. If you choose not to purchase, you can use your savings towards buying another home or for another purpose.

How is the purchase price set?

When you commence your tenancy, you will enter into a tenancy agreement, and an option deed, which provides you the option to purchase the property from Year 6 onwards.

When you’re ready to buy and inform CHC of your intention, CHC will arrange an independent market valuation. Two key figures are considered in connection with this market valuation:

- Target Purchase Price – the sum of your expected savings (saving 75% of the gap between Market Rent and the Discounted Rent) and your borrowing capacity as assessed by the bank (with the assumption that your repayments will not exceed 30% of your income, over a 30-year principal and interest loan, with variable interest rate); and

- Preservation Price– the minimum price for CHC to cover all project costs and preserve the government’s investment in the program.

If what you can afford (the Target Purchase Price) sits between the Preservation Price and the Market Value, CHC may apply a capital growth–based discount to bridge the gap.

This discount is not guaranteed and is only applied where market growth allows and will be tailored to individual circumstances.

What is capital growth (or capital gain)

Capital growth (or capital gain) is the change in a property’s value over time.

If the property becomes worth more than it was when you started, that increase is capital growth or a capital gain. If the value goes down, that’s called negative growth or a capital loss.

What if I can’t save the full deposit?

If you’ve saved at least 5% of the required purchase price as a deposit, you may still be eligible for a discount at CHC’s discretion, especially if you’ve faced challenges like illness or caring responsibilities. If you haven’t saved 5%, you can still buy at full market value, though you may find it difficult to secure a loan.

How much will I pay in rent and savings?

You’ll pay just below 75% of the market rent, and you’re expected to save at least three quarters of the gap between your rent and the full market rent. Together, your rent and savings should be less than 30% of your gross household income, to keep things affordable.

What makes this Program different from other affordable housing or first homebuyer schemes?

This Program is unique because it combines affordable rent, structured savings, and a clear pathway to ownership, with flexibility and support built in.

The discount is tailored to your situation at the time of purchase, not fixed upfront, and the Program is designed to help you build long-term financial security.

How many homes are available in the pilot?

There are 22 new townhouses in the pilot: 4 one-bedroom, 15 two-bedroom, and 3 three-bedroom homes.

How much should I save? Towards a deposit (Example)

Before entering the Program, you’ll be asked to meet with your bank or a readiness partner to discuss the Program, your savings requirements and the plan to purchase. This should give you a clear sense of borrowing capacity and how much you should save.

Over the term of the pilot, tenants are expected to save 75% of the gap between their discounted rent and the market rent, while keeping combined rent and savings below 30% of gross income.

Formula:

Target Savings = (Market Rent – Affordable Rent) × 75% × Years in the Pilot

This helps ensure the rent discount converts into real, measurable savings and provides a consistent benchmark for CHC to monitor progress or offer additional support if needed and possible.

What is gross household income?

Your gross household income is all income you get before you pay tax on it. It includes, but not limited to:

- wages from employment

- profit from your self-employed business

- Centrelink payments

- Family Tax Benefits

- bank interests

- shares/dividends

- pension allowances

- scholarship stipend.

Your gross household income includes the income of all occupants who will live in the home and who are over 18 years old. Such occupants may include:

- any parents

- any siblings

- any children or other dependents over 18.

You should not include the income of any people you currently live with but are not going to live in the home. For example, if you live with your parents or housemates, but are not going to live with them in the home, do not include their income.

If you have more than one job you will be asked to provide evidence of your income from all of your employers. If you are self-employed you will be asked to provide evidence about the net trading profit or gain made in the ordinary course of carrying out your business.

Who manages the homes?

CHC develops and sells the homes to CHC Strathnairn One Limited, a Special Purpose Vehicle (SPV) which is its subsidiary. The SPV holds the tenancy and option-to-buy agreements, while CHC continues to manage the properties and support tenants throughout the Program.

What happens if my income exceeds the affordability income limits during the first five years?

If your income increases, we’ll review it as part of our annual eligibility assessment (the same process we use across our affordable housing portfolio).

If your income increases to the point where you could reasonably afford private rental or ownership without assistance, you may no longer be eligible for the Program. These levels are indicated in the Program ongoing income thresholds. In that case, and at CHC’s discretion, you would be issued with 12 months’ notice to find more suitable accommodation, and you will no longer have an option to purchase the property.

The idea is that this Program helps those who need it most and if you’re in a stronger financial position, it’s a positive outcome and creates availability for others.

What if my income goes down or I lose my job?

If at the time of your annual income review you are found to be ineligible for affordable housing due to a significant drop in income, CHC will do everything we can to support you in transitioning to housing that is more affordable and appropriate to your circumstances. In this situation, a 12-month notice to vacate will be issued, giving you time to explore alternative housing options with our support.

However, if your circumstances change during the notice period such as an increase in income then you are welcome to provide updated income details to CHC for reassessment. If you are found to be eligible again, your tenancy will continue under the Program and the termination notice will be withdrawn.

What if my household changes (e.g. I get a partner or have children)?

Household composition is reviewed annually. If your household changes, we’ll reassess to help ensure the home is still the right fit. This will be assessed against the ongoing income thresholds aligned with the ACT Community Housing Income Limits.

For example, if during the Program period, a partner moves in and the household income rises above the Program’s income limits you may no longer qualify. In that case, you would receive 12 months’ notice to find alternative housing.

If it is during year 6 to 10, which is during the purchase window period, you would still be able to exercise your option deed should you choose to do so, so long it is within the 12-month notice period.

Can I sublet?

No. This would breach your lease agreement.

Do I lose all the savings or is there an exit cost if I must exit the Program?

No, any personal savings you’ve accumulated remain entirely yours. There are no exit fees associated with leaving the Program beyond the requirements under your standard residential tenancy agreement.

What happens if I become ineligible during Year 6 to 10?

The affordable rent phase is not indefinite. If your circumstances change and you no longer meet the Program’s income requirements (either earning significantly more or entering financial stress below the minimum threshold), you will be afforded 12 months to either:

- Exercise your option to purchase the property in accordance with your option deed requirements; or

- Exit the Program and seek a more appropriate housing option – whether that’s a lower-rent CHC property (subject to availability and eligibility) or a suitable market alternative.

This approach ensures the Program remains fair and targeted. It is designed to support tenants who are actively building towards ownership, not to provide long-term discounted rent where the original intent no longer applies.

Why does the Program apply annual eligibility checks?

The B2R2B model is designed for tenants who are building towards ownership. Before you have purchased the property and up to year 10, you are still first and foremost an affordable housing tenant accessing discounted rental benefit.

Annual reviews after ensure homes are still being utilised by households who are in housing need transitioning to ownership where possible, and the Program continues to serve households who need it most.

Will the tenancy be subject to a standard tenancy agreement?

Yes, you will sign a standard tenancy agreement under the Residential Tenancies Act 1997 (ACT) (RT Act), but it will contain special conditions regarding the Program, as well as incorporating some provisions of the RT Act regarding community housing provider landlords.

All of your rights described in this document will be subject to CHC Strathnairn One Ltd rights as a landlord under the RT Act (for example, to take action if you breach fundamental tenancy terms, such as compromising the quiet enjoyment of neighbours).

Can I leave the Program voluntarily?

Yes. If you choose to exit the Program before purchasing, you can do so by giving appropriate notice. However, you will not be entitled to a share of the capital growth.

Can I move to a different home within the same development?

Transfers may be possible, subject to availability and eligibility.

If your circumstances change and you need a different property size (larger or smaller), CHC may support a transfer within the development. If approved, you can continue participating in the Program. This is at CHC’s discretion and will be determined on a case-by-case basis.

Why does the Program have eligibility criteria of single women aged 25–45?

The eligibility settings reflect the specific group the Program is designed to support single working women who are consistently missing out on home ownership under current market conditions, despite stable employment and strong rental histories.

These criteria are based on policy alignment, evidence, and practical considerations. Women in this age group are consistently over-represented in:

- long-term renting

- lower lifetime earnings

- reduced superannuation

- difficulty saving a deposit

- higher risk of housing stress and financial insecurity in later life

National data shows single women over 45 are one of the fastest-growing cohorts at risk of homelessness, and women aged 25 – 45 are the group most likely to be working, stable, and still unable to break into home ownership.

The Program is designed to intervene before women reach the crisis point experienced in later years.

To successfully transition from tenant to purchaser at the end of the 10-year period, applicants need to be within an age bracket lenders can reasonably finance over a standard loan term.

Setting an upper limit of 45 years increases the likelihood that lenders can offer mortgages with manageable repayment periods, strengthening applicants’ purchasing success and reducing financial risk.

A minimum age of 25 years helps ensure applicants have:

- completed tertiary study or vocational training

- established stable employment

- developed consistent income patterns

- reached a stage where long-term financial commitments are realistic

Younger applicants generally have stronger long-term earning potential and are therefore more likely to be able to save independently and access traditional lending without requiring a structured 10-year pathway.

How does the Program meet anti-discrimination and human rights requirements?

Australia’s and the Australian Capital Territory’s anti-discrimination laws provide that it is not unlawful discrimination where measures are designed to provide a bona fide benefit, achieve equality or meet a specific need.

The Program is designed to help single, working women aged 25–45 move into home ownership where this is otherwise difficult due to lending settings and other structural barriers. Single working women face documented barriers to home ownership (including access to mortgage finance, rental market discrimination, and gendered wealth gaps).

The Program has also been assessed under the Human Rights Act 2004 (ACT). While the eligibility criteria result in differential treatment, this is reasonable, necessary, and proportionate to the aim of advancing substantive equality and addressing documented home ownership barriers among single working women.

What if I’m not eligible for this Program? Are there other options?

Yes. The Program is one part of CHC’s broader services. If you are not eligible, CHC can provide information about other housing assistance options and programs which may be suitable. Find out more here.

How can I give feedback or make a complaint or appeal a decision?

CHC respects the right of all of our customers to make a complaint or appeal as they provide valuable feedback about our services and the ways they are delivered. If you would like to provide feedback, make a complaint or request a review of a decision regarding the Program, you may do so through CHC’s Complaints and Appeals Policy. Further information is available here. You may also contact the ACT Human Rights Commission or the ACT Civil and Administrative Tribunal (ACAT).

What if I have more questions or want to apply?

Submit your expression of interest application here, or if you have any other questions, submit a general enquiry.

An initiative of CHC Australia

CHC Australia

CHC is the largest provider of affordable and social housing based in Canberra.

We are a Tier 1 registered Community Housing Provider, with over 25 years’ experience delivering for the Canberra community.

Supported by strong partnerships